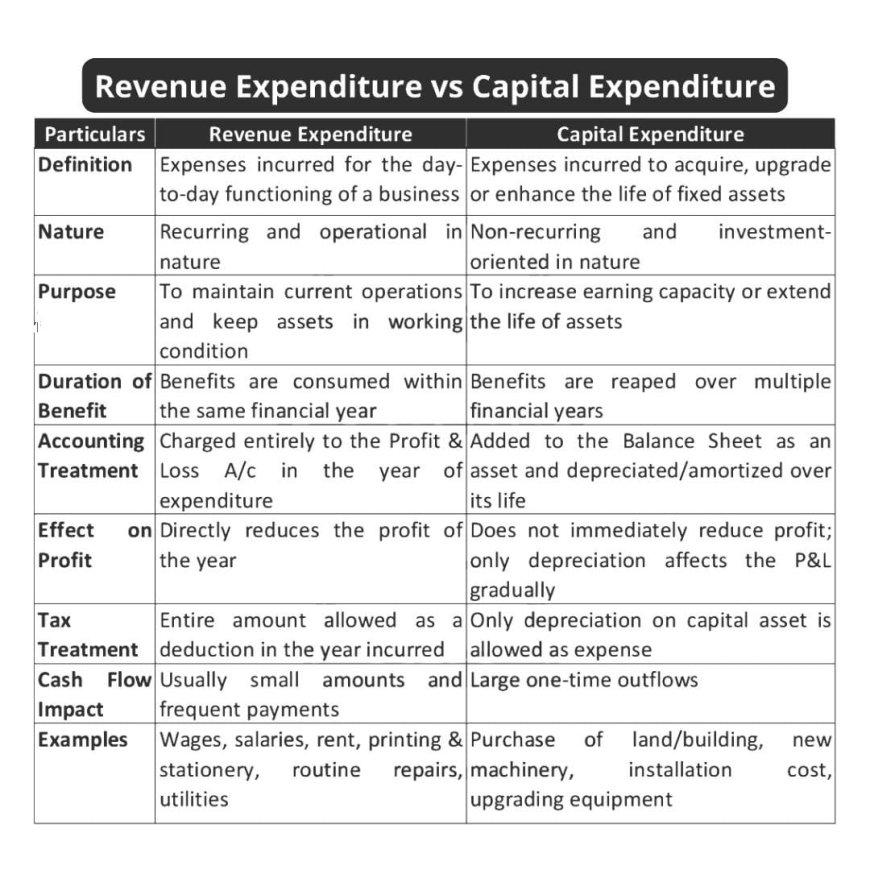

Revenue Expenditure vs. Capital Expenditure

This summary outlines the key distinctions between Revenue Expenditure and Capital Expenditure, two fundamental classifications of expenses in accounting. Understanding this difference is crucial for accurate financial reporting and tax computation.

Revenue Expenditure

- Definition: Expenses incurred for the day-to-day functioning and operations of a business. These are costs necessary to keep the business running smoothly on a recurring basis.

- Nature: Recurring and operational in nature. These expenses happen repeatedly as part of normal business activities.

- Purpose: To maintain current operations, keep assets in working condition, and facilitate the ongoing earning process of the business.

- Duration of Benefit: The benefits from these expenses are consumed within the same financial year in which the expenditure is incurred.

- Accounting Treatment: Charged entirely to the Profit & Loss (P&L) Account in the year the expenditure is made.

- Effect on Profit: Directly reduces the profit of the business in the year of expenditure.

- Tax Treatment: The entire amount of revenue expenditure is allowed as a deduction from revenue when calculating taxable income in the year it is incurred.

- Cash Flow Impact: Usually involves small amounts and frequent payments throughout the financial year.

- Examples: Wages, salaries, rent, printing & stationery, utility bills, routine repairs and maintenance.

Capital Expenditure

- Definition: Expenses incurred to acquire, upgrade, or enhance the life and earning capacity of long-term assets (fixed assets) used in the business.

- Nature: Non-recurring and investment-oriented in nature. These are typically one-time or infrequent large outlays aimed at long-term benefits.

- Purpose: To increase the earning capacity of the business, extend the useful life of existing assets, or acquire new assets that will provide benefits over multiple accounting periods.

- Duration of Benefit: The benefits from these expenses are reaped or enjoyed over multiple future financial years.

- Accounting Treatment: Added to the cost of the asset and shown on the Balance Sheet. The cost is then systematically spread over the asset's useful life through depreciation (for tangible assets) or amortization (for intangible assets).

- Effect on Profit: Does not immediately reduce the profit in the year of expenditure. Only the depreciation/amortization charged for the year affects the P&L account, thereby reducing profit gradually over the asset's life.

- Tax Treatment: Only the depreciation allowed on the capital asset each year is permitted as a deduction for tax purposes. The entire capital expenditure amount is not deducted in a single year.

- Cash Flow Impact: Typically involves large, one-time outflows of cash.

- Examples: Purchase of land, building, new machinery, vehicles, installation costs of new assets, significant upgrades or additions to existing assets.

Key Differences Summarized:

The core difference lies in the timing of the benefit. Revenue expenditures provide benefits within the current year and are expensed immediately. Capital expenditures provide benefits over several years and are capitalized (added to the asset's cost) and expensed gradually through depreciation/amortization. This fundamental distinction impacts a company's profit calculation, balance sheet valuation, and tax liability in any given year.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0