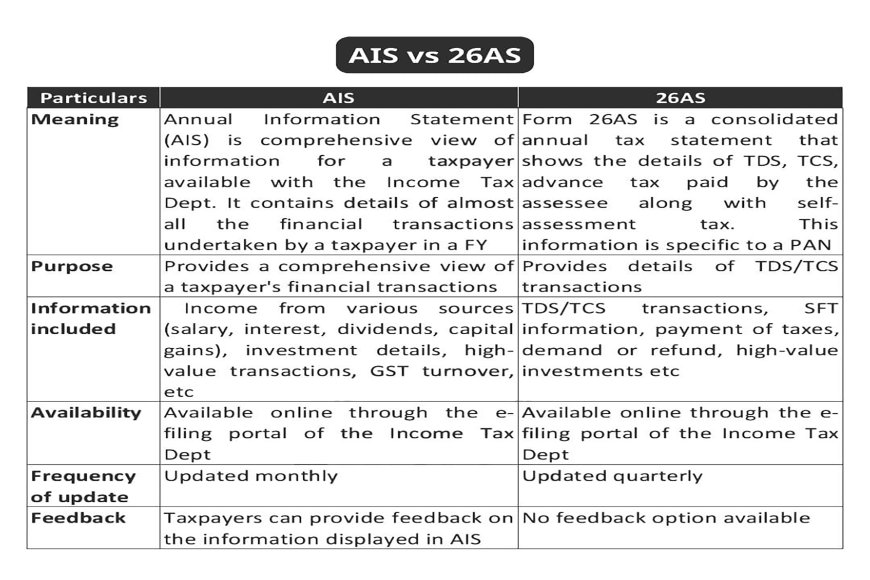

AIS vs 26AS

Summary: AIS vs 26AS

This summary outlines the key differences between the Annual Information Statement (AIS) and Form 26AS, two important tax statements available to taxpayers on the Income Tax Department's e-filing portal.

Annual Information Statement (AIS)

- Meaning: AIS is a comprehensive view of a taxpayer's annual financial transactions undertaken in a financial year (FY). It is designed to provide a more complete picture of a taxpayer's financial activities beyond just TDS/TCS.

- Purpose: The primary purpose of AIS is to provide a comprehensive overview of a taxpayer's financial transactions, facilitating easier and more accurate tax compliance and filing.

- Information Included: AIS includes a wide range of information such as income from various sources (salary, interest, dividends, capital gains), investment details, high-demand or refund transactions, high-value transactions, GST turnover, and other financial transactions.

- Availability: Available online through the Income Tax Department's e-filing portal.

- Frequency of Update: Updated monthly.

- Feedback: Taxpayers have the option to provide feedback on the information displayed in their AIS if they find any discrepancies.

Form 26AS

- Meaning: Form 26AS is a consolidated annual tax statement specific to a taxpayer's Permanent Account Number (PAN). It primarily details tax deducted at source (TDS), tax collected at source (TCS), advance tax paid by the assessee, and self-assessment tax payments.

- Purpose: Form 26AS serves as a record of taxes deducted or collected on behalf of the taxpayer and taxes paid by the taxpayer, helping in verifying tax credits available for claiming while filing the income tax return.

- Information Included: Form 26AS primarily includes TDS/TCS transactions, details of tax payments (advance tax, self-assessment tax), SFT (Specified Financial Transactions) information reported by various entities, and details regarding refund or high-value transactions (though AIS provides a more extensive list of these).

- Availability: Available online through the Income Tax Department's e-filing portal.

- Frequency of Update: Updated quarterly.

- Feedback: There is no direct feedback option available for information shown in Form 26AS.

Key Differences Summarized:

While both statements are accessible via the e-filing portal and provide tax-related information, AIS is broader in scope, including a wider array of financial transactions beyond just TDS/TCS, and is updated more frequently (monthly vs. quarterly for 26AS). A significant feature of AIS is the provision for taxpayers to provide feedback on the information presented, which is not available in 26AS. Essentially, AIS aims to be a more exhaustive repository of a taxpayer's financial footprint compared to the tax-credit focused nature of Form 26AS.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0