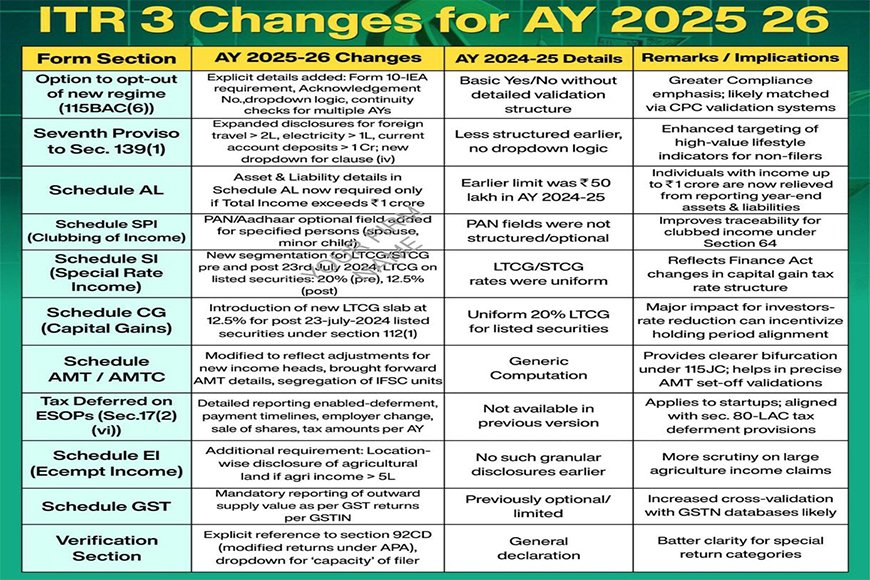

New ITR 3 Updates, AY 2025-26

Changes in ITR - 3 For AY 2025-2026

The Income Tax Return (ITR) Form 3 for Assessment Year (AY) 2025–26 has been updated by the Central Board of Direct Taxes (CBDT) to improve reporting accuracy and ease compliance for taxpayers engaged in business or professional activities.

Key changes include:

-

Asset & Liability Threshold Raised: Taxpayers now need to report assets and liabilities only if their total income exceeds ₹1 crore, up from ₹50 lakh, easing compliance for moderate earners.

-

Capital Gains Updates: Capital gains must now be split between gains arising before and after July 23, 2024. Losses on share buybacks after October 1, 2024, can be claimed, provided corresponding dividend income is reported.

-

New Section 44BBC: A new presumptive taxation scheme for non-resident cruise operators has been introduced under Section 44BBC.

-

TDS Reporting Changes: Additional disclosure is required for TDS under Sections 194Q (purchase of goods), 194R (benefits/perquisites), and precise TDS section codes must now be stated.

-

Foreign Assets: Expanded disclosure in Schedule FA is now mandatory, increasing transparency for foreign income and assets.

-

Deductions and Exemptions: Detailed disclosures are required under Sections 80C, 80U, 80DD, and 10(13A), with separate fields for each component.

-

Presumptive Income Reporting: Improved structure for Sections 44AD, 44ADA, and 44AE makes reporting presumptive income easier and more accurate.

-

Verification Options: EVC (Electronic Verification Code) can now be used by audit cases in place of Digital Signature Certificates (DSC).

-

Due Date Dropdown: A new feature allows users to select the applicable due date (July 31, Oct 31, or Nov 30) while filing.

These changes aim to streamline the return filing process, enhance accuracy, and improve compliance with tax laws.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0